SPRINGFIELD, IL – Governor J.B. Pritzker has proposed a bold $2 billion spending increase in Illinois’ budget, aiming to address critical areas such as education, healthcare, and infrastructure—all without introducing new taxes. The announcement, made during a press briefing at the state capitol, has sparked significant attention and debate among lawmakers, analysts, and residents.

A Balancing Act: Increased Spending Without New Taxes

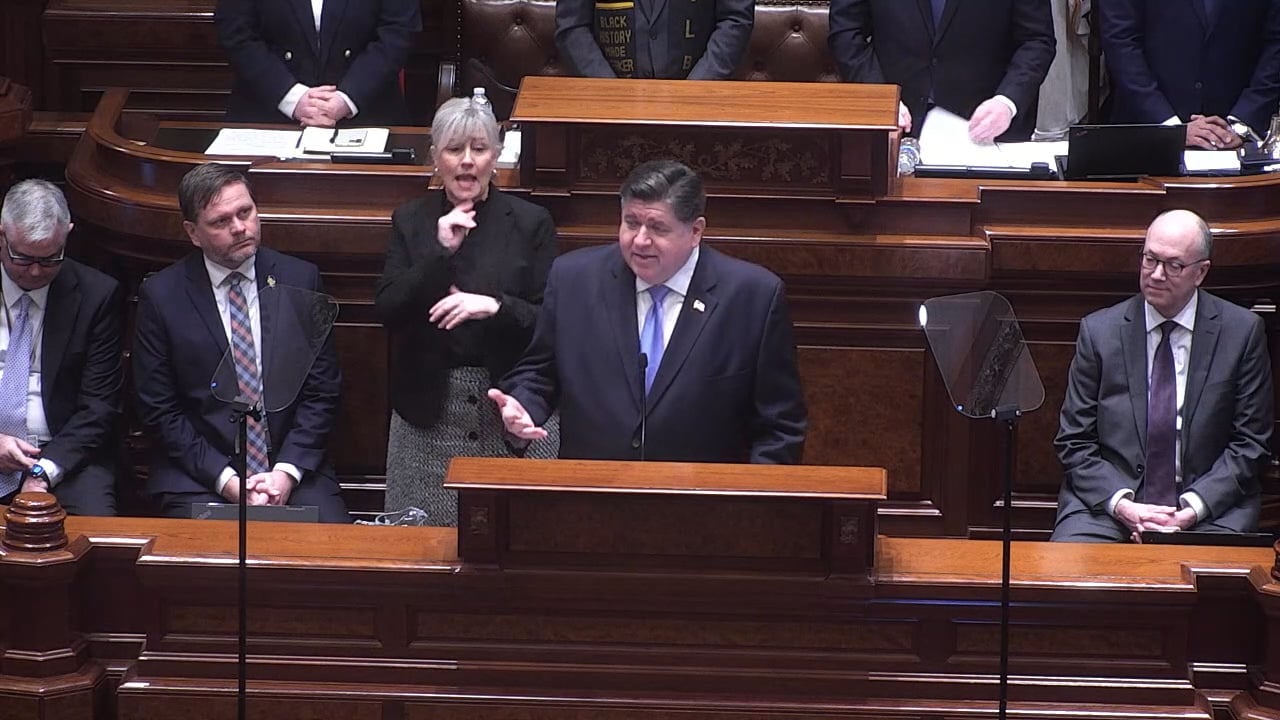

Governor Pritzker outlined the proposed budget as part of his administration’s efforts to bolster Illinois’ economic recovery and improve public services. “This budget prioritizes the needs of Illinois residents by funding essential programs while maintaining fiscal discipline,” said Pritzker during his address.

The governor emphasized that the spending increase would not require new taxes, thanks to the state’s improved financial position. Illinois recently received a credit rating upgrade—the first in over two decades—due to better-than-expected tax revenues and disciplined budget management.

According to the Governor’s Office of Management and Budget, the additional funds will be allocated strategically to support key initiatives, including public education, expanding healthcare access, and addressing long-overdue infrastructure projects.

Key Areas of Investment

- Education

The largest share of the proposed spending increase—$850 million—will go toward enhancing the state’s public education system. This includes higher funding for K-12 schools, expansion of early childhood education programs, and financial aid for college students.“Every child in Illinois deserves access to a high-quality education, regardless of where they live,” said Governor Pritzker. He also announced plans to reduce the teacher shortage by offering incentives such as loan forgiveness and competitive salaries.The Illinois State Board of Education has praised the proposal, noting that increased funding would help schools meet growing demands for resources and address learning gaps caused by the pandemic. - Healthcare

Another $600 million will be directed toward expanding healthcare services, particularly for underserved communities. The proposal includes funding to increase Medicaid reimbursements, improve mental health services, and bolster programs addressing the opioid crisis.“Healthcare should not be a privilege for the few but a right for all,” Pritzker asserted. The funding aims to ensure that all Illinois residents, especially those in rural and low-income areas, have access to affordable, quality care. - Infrastructure and Public Safety

A further $550 million is earmarked for infrastructure projects, including road repairs, bridge upgrades, and modernization of public transportation. The funds will also support public safety measures, such as new equipment for first responders and enhanced community policing programs.These investments are part of the ongoing Rebuild Illinois program, a multi-year infrastructure initiative launched by Pritzker in 2019.

Funding Sources and Fiscal Stability

The absence of new taxes in the budget plan raises the question of how the state intends to finance the spending increase. Pritzker highlighted three key funding sources:

- Revenue Growth: Stronger-than-expected income and sales tax revenues have provided the state with additional resources.

- Federal Aid: Illinois continues to benefit from federal pandemic relief funds, which have been instrumental in stabilizing the state’s finances.

- Debt Refinancing: By refinancing existing debt at lower interest rates, the state has saved millions, freeing up funds for new investments.

The Illinois Comptroller’s Office confirmed that the state has made significant progress in paying down its bill backlog, further improving its fiscal outlook.

Mixed Reactions from Lawmakers and Analysts

While the proposed budget has received praise from many for its focus on education and healthcare, it has also drawn criticism from some lawmakers.

Republican leaders have expressed skepticism, questioning whether the state can sustain increased spending without risking future deficits. “This proposal assumes revenue growth will continue indefinitely, which is a gamble,” said House Minority Leader Tony McCombie.

Meanwhile, some progressive groups have called for additional revenue measures, such as a graduated income tax, to ensure long-term funding for public programs.

Economists have offered mixed assessments. “Illinois’ financial position has improved, but relying solely on revenue growth and federal aid carries risks,” said Dr. David Merriman, a professor of public finance at the University of Illinois. “If the economy slows or federal aid decreases, the state could face challenges in maintaining these commitments.”

Public Reception and the Path Forward

The public response to the proposal has been largely positive, with many residents welcoming the focus on education and healthcare. “As a teacher, I’m thrilled to see increased funding for schools. It’s something we desperately need,” said Sarah Lopez, a high school educator in Chicago.

However, some taxpayers remain cautious, concerned about the potential for future tax hikes if revenues fall short.

The budget will now move to the Illinois General Assembly, where lawmakers will debate and negotiate its provisions. The governor has urged bipartisan cooperation to pass the budget, emphasizing that the proposal reflects the priorities of Illinois residents.

Conclusion: A Bold Vision for Illinois

Governor Pritzker’s $2 billion spending proposal represents an ambitious plan to invest in the state’s future without imposing additional tax burdens on residents. By focusing on education, healthcare, and infrastructure, the budget aims to address critical needs while leveraging Illinois’ improved financial position.

As the debate unfolds in the legislature, the proposal will serve as a litmus test for the state’s fiscal management and priorities. Whether it succeeds in garnering bipartisan support remains to be seen, but one thing is clear: Governor Pritzker is betting on Illinois’ economic resilience and the power of strategic investments to drive growth and prosperity.

Disclaimer – Our team has carefully fact-checked this article to make sure it’s accurate and free from any misinformation. We’re dedicated to keeping our content honest and reliable for our readers.